straight life annuity definition

A 25 depreciation for plant and machinery is available on accelerated depreciation basis Accelerated Depreciation Basis Accelerated depreciation is a way of depreciating assets at a faster rate than the straight-line method resulting in higher depreciation expenses in the early years of the assets useful life than in the later years. The gradual reduction of an assets valueIt is an expense but because it is non-cash it is often effectively a tax write-off.

Annuities And Individual Retirement Accounts Ppt Video Online Download

The assumption that assets are more.

. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization. Terminal cash flow has two main components. Under reducing balance method the depreciation is charged at a fixed rate like straight line method also known as fixed installment method.

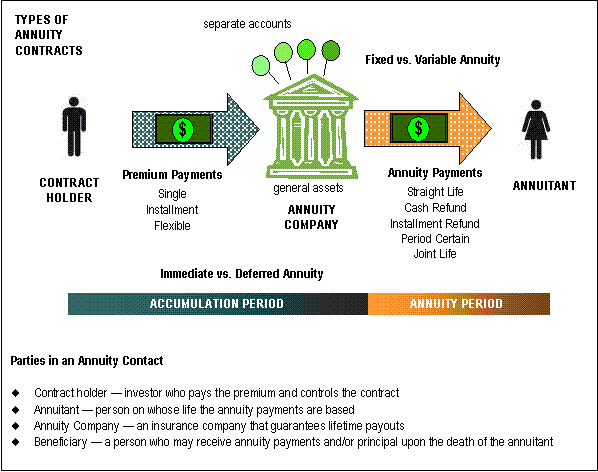

But the rate percent is not calculated on cost of asset as is done under fixed installment method - it is calculated on the book value of asset. The insurance company you buy the annuity from is managing that risk and you. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity.

Name a guardian for your children and a. Life insurance may be even more important if you have a child with special needs or college tuition bills. Beneficiary The person that youve nominated to receive your insurance pay-out in the event of your death.

At the end of its life the. Business management liability insurance is a type of policy that protects the company and covers exposures faced by directors officers managers and business entities that arise from. Insurance is a means of protection from financial loss.

RMS a Moodys Analytics company and world-leading risk modeling and solutions company today announces it will be releasing four new High Definition HD models including Europe. In the graph to the right the lines are straight which is appropriate given the assumption of a zero real investment return. As in the graph.

Because there are many different ways to account depreciation it often bears only a rough resemblance to the assets useful life. Cash flows associated with reversion of working capital to the level that. Proceeds from disposal of project equipment and.

It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. You can use your pension pot to get a life long regular income also known as a lifetime annuity to provide you with a guarantee that the income will last as long as you live. Your Upside May Be Limited.

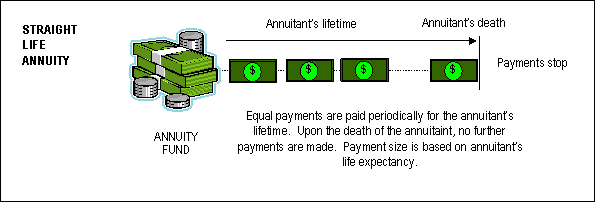

Retirement is the withdrawal from ones position or occupation or from ones active working life. This benefit stream is actuarially equivalent to a straight life annuity at age 70 of 260606 an amount greater than the section 415 limit determined at the original annuity starting date using the interest and mortality rates applicable to such date. Happening in a smooth gradual and regular way not suddenly or unexpectedly.

Terminal cash flow is the net cash flow that occurs at the end of a project and represents the after-tax proceeds from disposal of the project assets and recoupment of working capital. Lifespan is not known in advance can be reduced in some countries by the purchase at retirement. Thus the lump sum payment to D fails to satisfy the condition under paragraph c3 of.

Death benefit Usually seen in a term-life or other life insurance policy it refers to the amount paid out by the insurer to the beneficiary if you or the person insured dies when the policy is still active. When you buy an annuity you are pooling risk with all the other people buying annuities. That is a person or company usually may reduce hisherits taxable income by the amount of the depreciation on the asset.

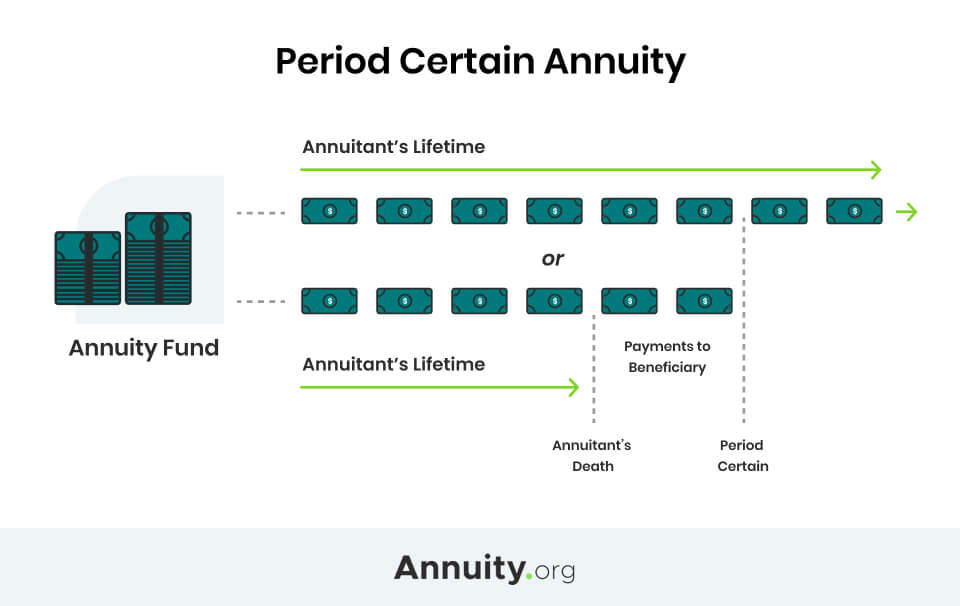

A person who receives an annuity for a specified term a temporary annuity or for the remainder of their life a lifetime annuity.

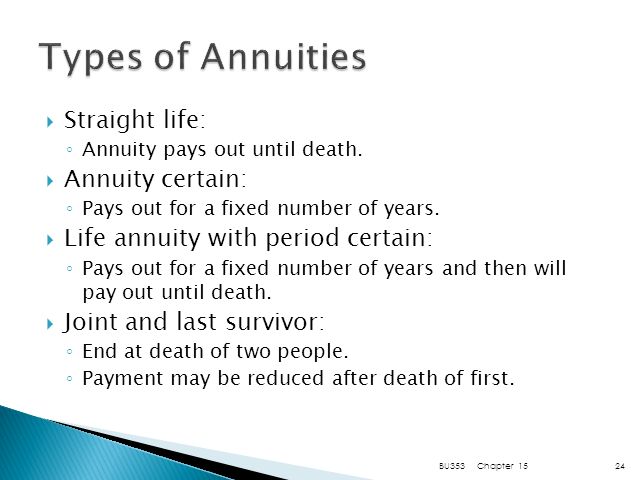

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

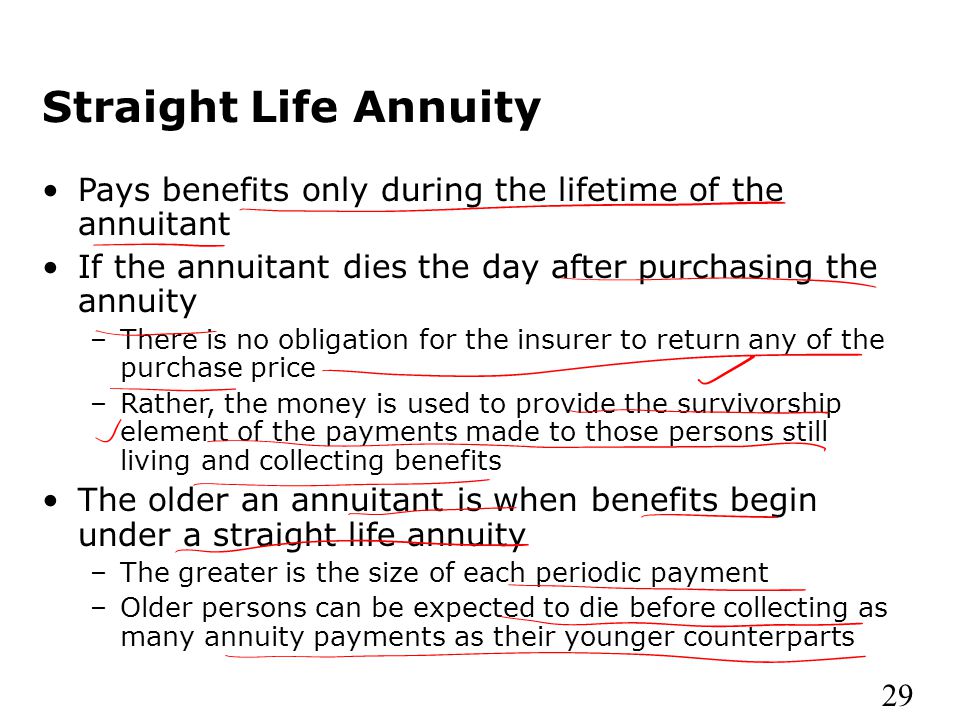

Straight Life Annuity Definition

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

What Is A Straight Life Annuity Everything You Need To Know

Period Certain Annuity What It Is Benefits And Drawbacks

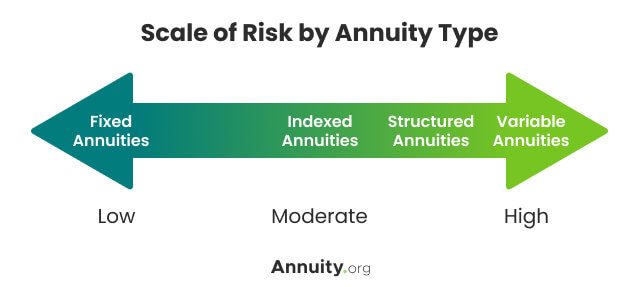

Types Of Annuities Understanding The Different Categories

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuities And Individual Retirement Accounts Ppt Video Online Download

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Providing Peace Of Mind In Your Retirement

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation